Grant Thornton Cambodia – considering business models and forward-looking information

The International Accounting Standard Boards (IASB) decided to replace IAS 39 with IFRS 9 Financial Instruments in response to strong criticisms of that Standard in the aftermath of the global financial crisis of 2007/8.

IFRS 9 fundamentally rewrites the accounting rules for financial instruments. A new approach for financial asset classification is introduced, and the now discredited incurred loss impairment model is replaced with a more forward-looking expected loss model.

As IFRS 9’s mandatory effective date is financial year on or after 1 January 2018, we strongly suggest that companies should have adopted the new Standard now. As well as the impact on reported results, many businesses, particularly businesses in banking sector, will need to collect and analyse additional data and implement changes to systems.

Certain key areas of the new IFRS 9 include:

Classification and measurement

The classification and measurement of financial assets was one of the areas of IAS 39 that received the most criticism during the financial crisis.

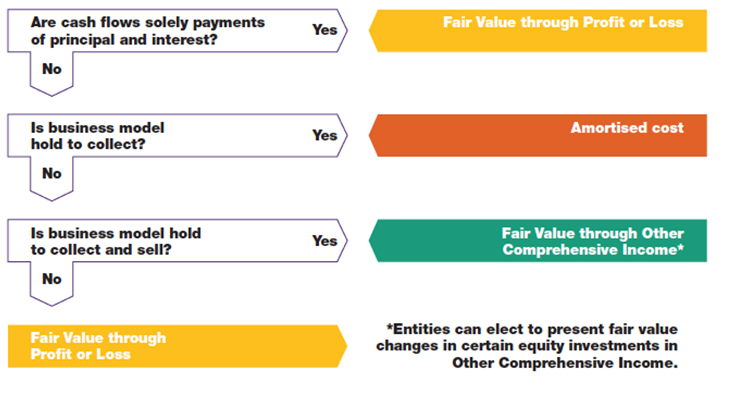

Under IFRS 9, each financial asset is classified into one of three main classification categories:

- Amortised cost

- Fair value through other comprehensive income (FVTOCI)

- Fair value through profit or loss (FVTPL).The classification is determined by both:

a) The entity’s business model for managing the financial asset (‘business model test’); and

b) The contractual cash flow characteristics of the financial asset (‘cash flow characteristics test’).

The business model test

IFRS 9 uses the term ‘business model’ in terms of how financial assets are managed and the extent to which cash flows will result from collecting contractual cash flows, selling financial assets or both. The Standard positively defines two such ‘business models’:

- A business model whose objective is to hold the financial asset in order to collect contractual cash flows (‘hold to collect’)

- A business model in which assets are managed to achieve a particular objective by both collecting contractual cash flows and selling financial assets (‘hold to collect and sell’).

The cash flow characteristics test

The second condition for classification in the amortised cost classification or FVTOCI can be labelled the ‘solely payments of principal and interest’ (SPPI) test. The contractual terms of the financial asset must give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding.

For the purpose of applying this test, ‘principal’ is the fair value of the financial asset at initial recognition. ‘Interest’ consists of consideration for:

- The time value of money

- The credit risk associated with the principal amount outstanding during a particular period of time

- Other basic lending risks and costs

- A profit margin.

Summary of classification model

IFRS 9’s classification model for financial assets:

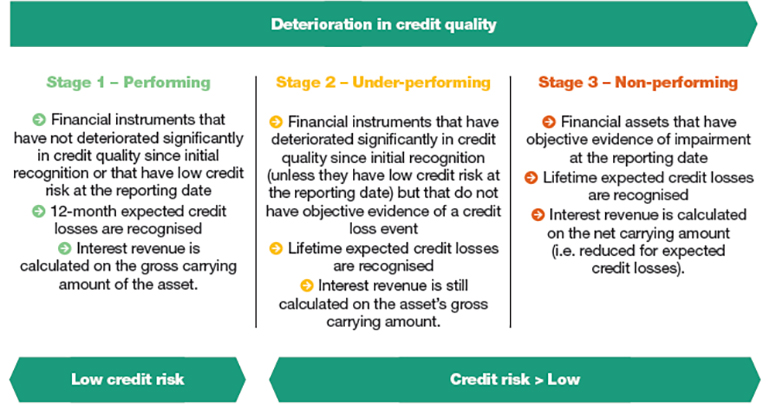

Expected credit losses

In publishing these requirements, the IASB aims to rectify what was perceived to be a major weakness in accounting during the financial crisis of 2007/8, namely the recognition of credit losses at too late a stage. IAS 39’s ‘incurred loss’ model delayed the recognition of credit losses until objective evidence of a credit loss event had been identified. In addition, IAS 39 was criticised for requiring different measures of impairment for similar assets depending on their classification.

IFRS 9’s impairment requirements use more forward-looking information to recognise expected credit losses. Also, in contrast to IAS 39, the amount of loss allowance is not affected by the classification of the asset at amortised cost or FVTOCI. Recognition of credit losses are no longer dependent on the entity first identifying a credit loss event. Instead an entity should consider a broader range of information when assessing credit risk and measuring expected credit losses, including:

- Past events, such as experience of historical losses for similar financial instruments

- Current conditions

- Reasonable and supportable forecasts that affect the expected collectability of the future cash flows of the financial instrument.

The three-stage process

The three-stage process reflects the general pattern of deterioration of credit quality of a financial instrument and is illustrated in more detail below. This three-stage model is symmetrical – in other words financial assets are reclassified back from stages 2 or 3 (lifetime expected losses) to stage 1 (12-months expected losses) if an earlier significant deterioration in credit quality subsequently reverses, or the absolute level of credit risk becomes low.

Transition

The transition to IFRS 9 is mainly retrospective, apart from the hedge accounting requirements. However, a purely retrospective approach would be prohibitively complex and potentially impractical. IFRS 9 therefore includes various detailed exemptions and simplifications.

For further enquiries or any information on this Standard, please get in touch with Ronald Almera at ronald.almera@kh.gt.com or +855 23 966 520

Grant Thornton (Cambodia) Limited: 20th Floor, Canadia Tower, 315 Preah Ang Duong Street, Sangkat Wat Phnom, Khan Daun Penh, Phnom Penh, Kingdom of Cambodia