As well as heading Cambodian, Lao and Myanmar operations for power tool giant Bosch, Andre de Jong is chairman of the Real Estate and Construction Committee of Eurocham Cambodia. He discusses Cambodia’s real estate boom, health and safety issues in the industry and developing Cambodia’s picturesque coast

What makes Cambodia an attractive destination for property investors?

Cambodia is the next frontier. It is quite an open economy, which means investments can be made fairly easily, and it is dollarised. It’s also experiencing steady growth and has a relatively stable government, so there are definitely a few reasons why Cambodia is the next logical step.

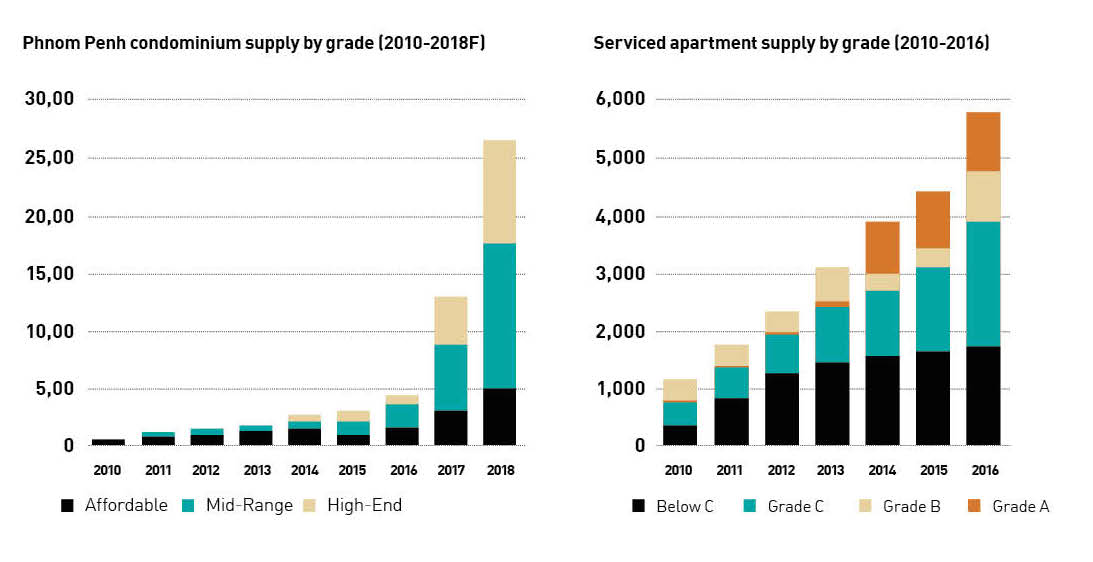

You can separate the market into condominium, office space, serviced apartments, retail, hotels and normal housing or gated communities. If you look at all those areas, I think condominium development is the most prominent and maybe the most dangerous. There is a lot of interest from investors in the apartments, but who will live in them? The overseas investor from Singapore that bought three apartments will not live in them. And this will eventually show in the rental market, the secondary market. It will become overheated.

But other markets are fairly normal. The office space market has very steady growth; the occupancy rate is around 80%. Serviced apartments are also seeing steady growth. So in general the market is still strong. My only concern is the condominiums.

What will happen when demand for condominiums fails to meet supply?

There will be a slowdown, but the market won’t crash in the same way the US market did. That’s not going to happen in Cambodia – the market is too isolated and too small when compared with the region. Some smaller investors might be affected because if they are not rich and invest in an apartment that they later cannot rent out, they will incur certain costs that might be impactful.

But that is a very limited impact. I think the majority of the people that invest in those apartments will be fine; they will be able to sit it out for a couple of years.

You spoke about how easy it is for investors to enter the market here. Do you think there is a need for increased regulatory oversight in Cambodia?

There is an issue related to companies failing to complete building projects. These projects then develop negative auras around them, and people begin to see them as ghost buildings that are doomed; they don’t want to live there or have their office there. This is what has happened with Gold Tower 42. I would start over with that one. It’s in a prime location, so there are definitely others that want to invest there.

Do you think there is a need for greater health and safety protection for construction workers in Cambodia?

It is one of our top priorities and part of our MoU with the government. Following a forum on health and safety within the construction industry, which we ran in conjunction with the Cambodia Constructors Association, the government decided to reinstate a little-known 2001 prakas [regulation] on health and safety. It has since been updated to reflect the changes that Phnom Penh has gone through over the past 16 years and has been included in a health and safety booklet – designed by the construction consultancy firm Archetype – that will be handed out at our future events. The ministry is open to change but, in the end, it will come down to enforcement.

Moving south, what do you make of the construction sector on the coast?

There’s basically no coastal law or development planning. Our MoU also mentions that we want to work on coastal development and its corresponding law.

We have two experts from France that have already started drafting this coastal development law, which we hope will help to boost investor confidence. Until now, it has been very opportunistic: if you committed enough money, you could do whatever you wanted. That was the feeling. But [in the future] it will be nicely regulated and there will be environmental protection. It’s a beautiful coastline so there are definitely opportunities.

With the commune elections in June and the national elections next year, are you worried that any political instability could have an impact on investment in Cambodia?

Any election brings with it uncertainty. It will impact certain investments at some point. Certain companies might adopt a ‘wait-and-see’ attitude. However, in the long-term, there will be no stop on growth; no stop on the development. That will continue, absolutely.

Whether the government changes or doesn’t change, they all have the development of the country as their priority and that will happen anyway. You cannot stop it. I’m positive on that.