While examining the economic landscape and financial policies necessary to propel growth with Sok Chenda Sophea, his passion for the job becomes immediately clear. He deep-dives into the opportunities the Kingdom currently holds for international investors, speaks energetically about a renewed investment law, and lists a number of incentives the Cambodian Government is willing to offer in order to attract broader investment to the country following the 2020 pandemic’s impact on its economy.

Sok Chenda Sophea has spent 23 years at the helm of the institution not only charged with pushing forward the Kingdom’s industrialization but also attracting the necessary investment in what were defined as key areas of economic growth in 1994. To be submitted in 2021, an updated investment law builds upon the success of previous strategies to attract investment to Cambodia, as a consistently strong economic growth over the last decade has been driven primarily by the extraordinary openness and freedom afforded to investors under the Kingdom’s investment policy.

“Back in 1994, we looked at the investment laws of other countries. We realized the limitations they put on foreign investment were actually burdens for their economy,” Sok Chenda Sophea says. “We knew the only way for Cambodia to move forward was to open our doors widely and offer as many incentives as possible in order to create jobs for an economy with no cohesion at the time.”

Should the investment law not be updated more regularly following the last review in 2003? “We have to balance between being more flexible to adjust to the fast-changing world economy and technological innovations, and giving assurance and predictability to investors. This is why we have tried to put the key points in this new law, and leave some room for more details to be stated in either a sub-decree or the Law on Public Financial Management, which is updated every year if necessary.”

With open door policies such as those allowing non-Cambodians to own 100% of a business, the country stands out from its neighbors in the region, and as a result, many investors have settled in the country. However, although foreign direct investments (FDIs) have been steadily flowing in, not all sectors of the economy have equally benefited.

As the country faces new challenges to broaden its economic base, increasing diversity is addressed in the upcoming version of the law, while the core tenets of freedom and openness are maintained. Along with including traditionally significant sectors such as tourism and manufacturing, the addition of other, existing or emerging industries to the list of sectors that are to enjoy fiscal incentives is hoped to have an important effect on the nation’s role in local, regional and global supply chains.

“We still want investments in garment, textile and footwear – but we also want more diversified investments, particularly those with higher value addition. For the garment industry, we want to have industrial clusters and more vertical supply chains. That’s how we drafted the law. We plan to give incentives to merit based activities such as R&D, human resource development, and machinery upgrades,” Sok Chenda Sophea explains.

New technologies are rapidly changing every class of business, and there is a growing appetite in Cambodia to leapfrog development through innovation and to apply them in multiple sectors of the country’s economy.

He elaborates on Cambodia’s favorable position in this regard, citing an increasingly digitized citizenry. “We are ready for these industries. Our people are tech-savvy and we have some of the highest rates of smartphone usage in the world. We can leapfrog and catch up to other countries and take advantage of these massive economic opportunities.”

With regard to advances on government digital services, in June 2020, the Royal Government launched a new online business registration system, CamDX, a single gateway for business registration that reduces application approvals to only eight working days. Six ministries or government institutions are integrated into the system: the Ministries of Interior, of Economy and Finance, of Commerce, of Labour and Vocational Training, the General Department of Taxation, and the Council for the Development of Cambodia. CamDX is designed to facilitate the ease of doing business and attract more investments to the Kingdom.

Whether it relates to advances in fintech, telecommunications, or computer science, Cambodia is well-situated to grow its position in technology industries, and incentivizing these sectors could help the country to catch up to more advanced regional peers.

Another area likely to see progress is the agricultural sector and its related processing and export industries. Long a pillar of Cambodia’s economic output, agricultural production has yet to meet its financial potential, namely due to the reliance on inefficient methods and a lack of industrialized processes and the skills necessary to upscale local production.

We knew the only way for Cambodia to move forward was to open our doors widely and offer as many incentives as possible in order to create jobs

“Agriculture is a key sector in the proposed law as so many Cambodians depend on it for their livelihoods,” he says. “The pandemic has laid bare risks to food security globally. Cambodia has much untapped potential in agriculture and agro-processing and we are keen to leverage these resources.” Proposed incentives include up to 150% tax deduction for production machinery upgrades and tax exemptions on imports of these systems, which could significantly increase the deployment of modern technology to further expand Cambodia’s agricultural sector.

Another key sector that stands to be updated is green and renewable energy. This is a particularly important element of the policy considering a number of leading clothing brands operating in Cambodia have, of late, cited the country’s increasing reliance on fossil fuels as a potential source of conflict with low- or no-emission business strategies in their global supply chains.

“Among the sectors we consider to be a priority and eligible to be qualified investment projets (QIP), are investments in environmental protection and management and green energy. We have adopted a Law on Environmental Protection and Natural Resource Management, and the sub-decree on Environmental Impact Assessments,” he says.

Skills training also receives special attention, as many of the new industries included in the draft law rely on a highly-trained workforce: a 150% tax deduction would be offered when investments include education and vocational training. Sok Chenda Sophea believes that promoting this type of upskilling activity will benefit the economy as a whole. “The government is well aware of shortcomings in available skills. We need to provide incentives so that employers see training as an extension of their investment in Cambodia, and not as an afterthought.”

“Incentives will vary in accordance with the types of industries we seek to attract, but the bottom line is clear – investors will be encouraged to evolve with a maturing economy.”

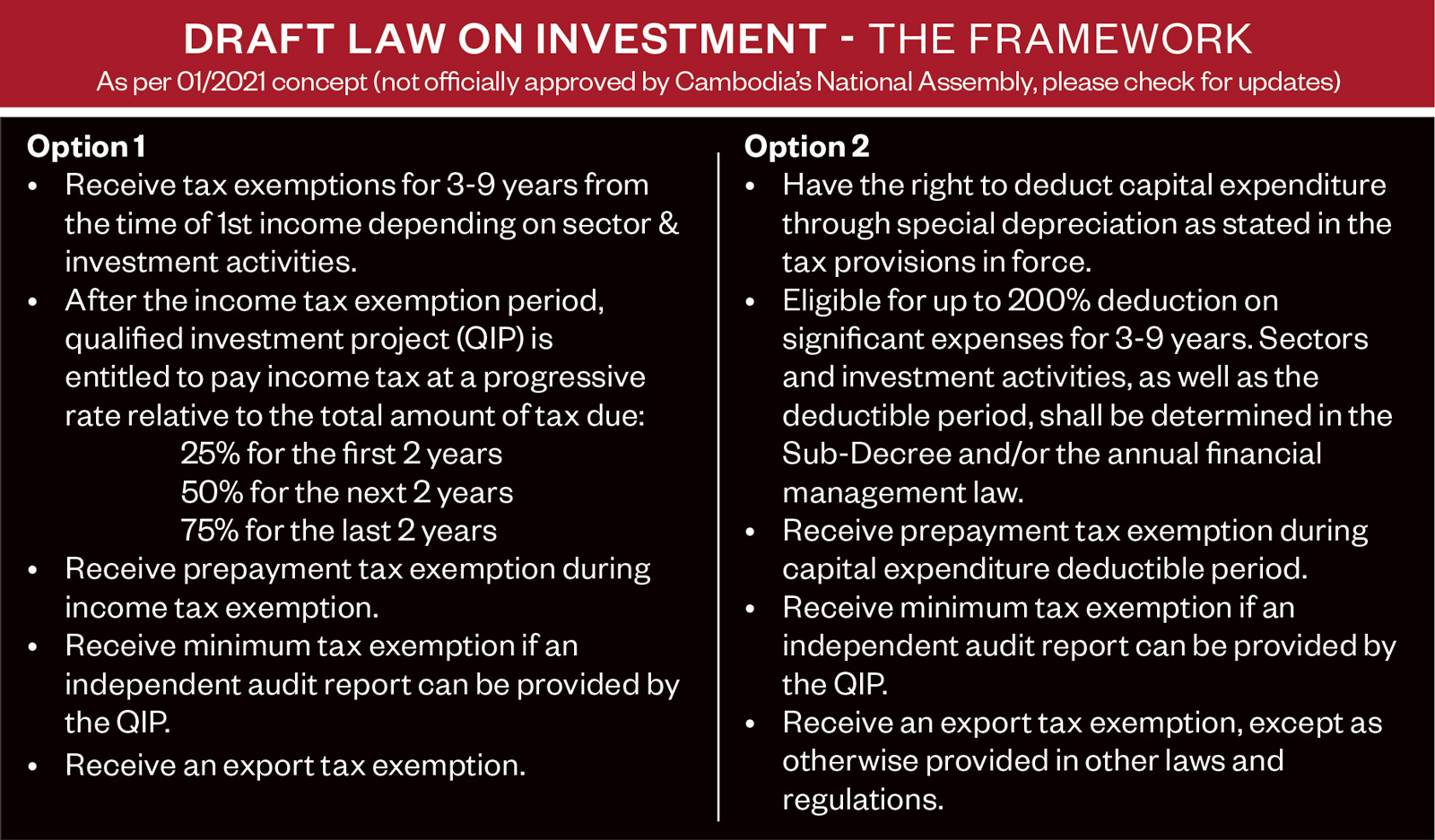

Eligible enterprises would have two options, one favoring significant tax exemptions for up to nine years, and another that allows deductions, in some cases up to 200% of capital expenditures, over a similar time frame.

Flexibility is a key pillar of the proposed law, as policymakers would have the ability to tailor fiscal incentives to enterprises that don’t fall into any sector named explicitly in the document. A provision allows for additional incentives not specifically outlined in the law to be extended to enterprises that have the potential to contribute to economic development in the long term.

Among the sectors we consider to be a priority and eligible to be QIP’s, are investments in environmental protection and management and green energy

As the global economy is a rapidly changing landscape, in partuclar since the beginning of the 2020 global crisis, the planned updates in the investment law demonstrate the Royal Government’s ambition to not be left behind. Sok Chenda Sophea says he has high hopes that a fresh look at investment incentives and regulations will help the country to foster the economic stability it has worked hard to secure during the past two decades.

“Cambodia has made incredible progress in the last twenty years, and we are thankful. But we are not finished,” he says. “Cambodia has so much to offer to the world, and we must continue to work with it if we are to see our country rise to its full potential.”

This article was first published in Globe Media Asia’s Focus Cambodia 2021-22 magazine.