It’s hard to underestimate the effects that fintech innovations will have on the world of finance and banking. With the potential to completely change how we think about and interact with money, Cambodia is a prime example of just how quickly these technologies can transform the face of daily life.

In the Kingdom, the majority of advances in fintech came a decade ago in the form of eWallets and digital payment solutions. However, in order to take advantage of the true potential of these fintech systems, a more robust and cohesive ecosystem that offers more than just money transfers and cashless payments will be needed. In Cambodia, a number of players are working together on just these sorts of developments, and the implications are big.

The existing infrastructure and pervasiveness of personal technology make Cambodia particularly prepared for these more profound developments. With 20.8 million mobile connections, representing 124% of the population, Cambodia has one of the highest connection rates in the world. Of these millions of mobile connections, 10.7 million are smartphones that take advantage of some of the cheapest and most expansive data coverage in the region. At roughly $1 per GB, with 3G and 4G coverage reaching around 85% of the population, Cambodians have the tools and access to match their enthusiasm.

One example of the population’s willingness to utilize new innovation is the success of Wing. Launched over 10 years ago, Wing remains the country’s leading mobile financial service provider, thanks to its 100% coverage and nearly 8,000 Wing Cash Xpress outlets throughout the country. Offering a variety of services, including local money transfers, cashless payments and instant international money transfers to over 200 countries, the role Wing has played in introducing fintech to Cambodia cannot be overstated.

On a recent episode of the Southeast Asia Globe’s Anakut podcast, Manu Rajan, Wing’s CEO, explained the first-mover’s effect on the landscape. “In 2009, when we started, we had about 27 commercial banks, but we had a single-digit percentage of people with bank accounts. Today we have around 10 million unique users, utilizing Wing for a variety of functions.”

Wing’s success has demonstrated the country’s potential for mass adoption of fintech innovations, and it has also highlighted areas within the ecosystem that are primed for expansion. Much of this broader development is aimed at Micro, Small and Medium Enterprises (MSMEs) as well as promoting financial inclusion of the bankless population in the country.

Several startups have recognized gaps in the ecosystem and began providing Software-as-a-Service (SaaS) solutions to MSMEs. Accounting, bookkeeping, and the ability to manage invoices, payment schedules, and bank accounts are all features of these inclusive software systems that help bridge the gap between MSMEs business practices and the world of digital finance.

Rajan explained the situation facing many MSMEs. “We have about half a million SMEs. About 98% of them are said to be micro SMEs, and the majority of these people don’t even have proper registered entities or records of credit-worthiness. This makes it very difficult for these people to come into the formal financial sector.”

In 2009, when we started, we had about 27 commercial banks, but we had a single-digit percentage of people with bank accounts

Manu Rajan, Wing

Some fintech startups – BanhJi being a prime example – are going even further in their strategies to bring Cambodia’s MSMEs into the 21st century. Along with providing SaaS for tax filing, the startup is collaborating with PPCBank to provide its users with SME business loans based on data from their use-history with the platform.

Founder and CEO, Chankiriroth Sim elaborated on the way a layered strategy for these fintech systems will produce a more functional and robust ecosystem. “The development of online tax filing and financial reporting will give rise to more players in the field,” he said. “In turn, the MSMEs’ digital adoption of financial management will increase and uncollateralized, digital lending can be made scalable.”

Facilitating these loans using alternative scoring algorithms to determine the creditworthiness of potential MSMEs candidates would help promote an environment of financial inclusion and improved opportunity. He continued, “New sources of data would provide the ability to increase reach and would enable scaled access to credit for MSMEs and underbanked customers.”

Personal loans, social media, bill payment, and mobile top-up history could provide the data necessary for these innovative enterprises to produce functional credit histories and greater access to capital without the need for the microfinance institutions that are often the only option for underbanked Cambodians.

Wing’s Rajan weighed in on the human impact of these innovations in Cambodia, “Financial inclusion, for us, is being able to hand-hold these people who do have big dreams, big ambitions, but don’t have access to finance to fulfill those dreams and improve their lives.”

This focus on the inclusion of unbanked individuals and the thousands of informal MSMEs across the country is further addressed by the development of electronic Know-Your-Customer (eKYC) protocols.

Identifying use cases that will provide our customers with meaningful and convenient solutions to their financial needs is at the heart of our strategy

Zokhir Rasulov, ABA Bank

Chankiriroth Sim explains the potential this technology could have for Cambodia, “The adoption of eKYC would present an opportunity to increase access, particularly to the unbanked market segment, reduce onboarding cost, and improve convenience and efficiency of services.”

Using biometric data algorithms to streamline and digitize the onboarding process, costly face-to-face meetings could be bypassed, allowing rural Cambodians to access services without the need for a physical visit to a bank branch.

These digital innovations represent a shift away from – or at least a reimagining of – traditional financial processes, however, banks remain key stakeholders in the landscape.

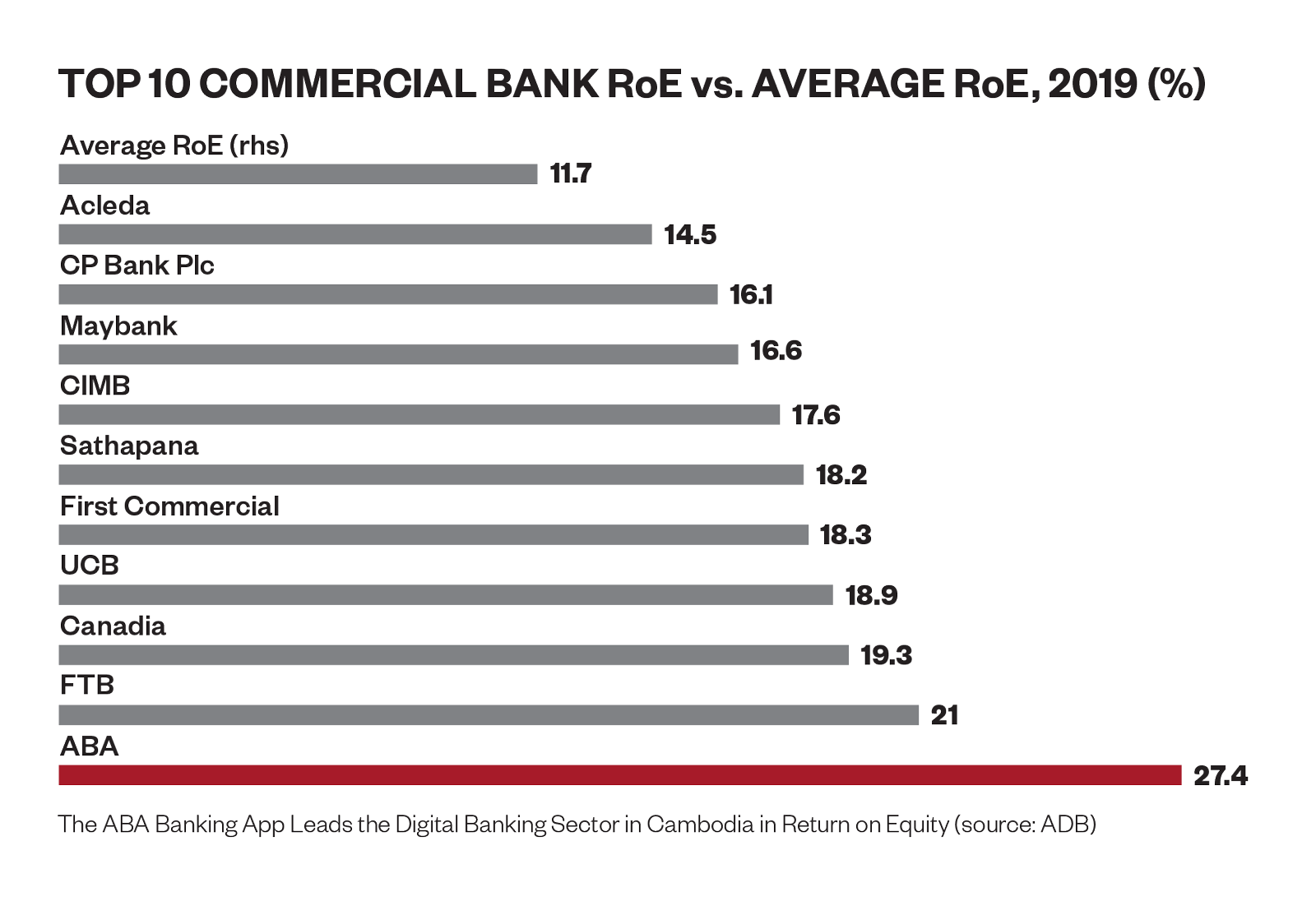

Financial institutions play an essential role in promoting fintech solutions, however, not all of Cambodia’s dozens of commercial banks have been successful. The institutions that have embraced a speedy and highly flexible, tech-focused approach have expanded their stake in the market significantly.

With over 1 million mobile banking users and over 40,000 merchants taking advantage of ABA Bank’s digital services, the bank demonstrates a strategy that is designed around the specific needs of their customers. Celebrating its 21st anniversary in 2021, ABA has become Cambodia’s leading private financial institution and their avdvances in digital solutions are an essential part of their strategy to maintain this prominent position.

ABA’s Chief Digital Officer, Zokhir Rasulov explained the reasons behind the bank’s continued expansion in the sector, “We don’t view the market in terms of competition. Instead, identifying use cases that will provide our customers with meaningful and convenient solutions to their financial needs is at the heart of our strategy.”

He continued, “This approach, in conjunction with our dedicated in-house development teams, has allowed us to expand our place in the market and become a leading financial service provider.”

Offering a suite of digital financial services to individuals and businesses with a participation rate upwards of 85% among clients and the upcoming launch of a digital onboarding process for rural and unbanked populations, ABA continues to push the development of Cambodia’s fintech landscape.

Cambodia’s central bank is pushing the country’s digital finance ecosystem even further and industry and technology experts around the globe have taken notice.

Utilizing distributed ledger technology and cryptographic functions, Bakong is a blockchain-based digital ecosystem developed by the National Bank of Cambodia (NBC), and is the nation’s cutting edge answer to the disjointed and competitive fintech landscape.

While Bakong uses the distributed ledger technology (DLT) pioneered in cryptocurrencies, the NBC’s Director General and a key spokesperson for the project, Chea Serey, is quick to point out that it is not a central bank digital currency (CBDC) like the projects underway in other countries. Instead, Serey refers to Bakong as a “backbone payment system.”

She sees the fragmented nature of the current fintech landscape as a major obstacle restricting the growth of ecosystems within the country. In a video conference with CoinDesk, a leading cryptocurrency news service, Serey addressed the ways that this disjointed landscape negatively impacts the functionality of these systems.

“We’ve got the eWallet providers who are not connected to each other and who are not connected to the banking system,” she explained. “The eWallet customers are completely isolated from each other. If they are to send money to somebody, it has to be within the same service provider system.”

Bakong will solve this issue by producing a single platform on which financial institutions and payment service providers (PSPs) can register and function within a unified ecosystem. After downloading the Bakong app to their phone, customers will register with their preferred institution from the list of participating banks and PSPs. Once they are registered, users will then create an account and a wallet with Bakong that will allow them to move funds between accounts with different banks as well as facilitate immediate peer-to-peer (P2P) cash transfers.

It is worth noting, however, that Bakong doesn’t aim to push PSPs and other banks into obsolescence, as explained in the project’s whitepaper. “Bakong will not eliminate the intermediary function of banking institutions and payment service institutions. It requires these institutions to review and manage customer information, conduct KYC procedures, and open accounts for customers.”

Instead, the project is looking to consolidate as many players in the ecosystem as possible, without absorbing their markets. “The idea is to create interoperability, so the more players we have in the system, the better it is,” Serey added.

Another key goal of Bakong is to increase financial inclusion among Cambodia’s large rural population. “It is difficult for people to go to normal commercial banks, which are mostly found in urban areas, to open a bank account. Because of tedious KYC procedures, most people are more keen to open an eWallet account. We saw that as an opportunity,” Serey explained.

An example may help elucidate how Bakong will help bring the country’s unbanked population into the financial system:

A family lives in the countryside, miles from a bank. Traveling to a branch to open an account is time consuming and inconvenient, but one of the country’s thousands of Wing locations is just down the road. After completing Wing’s straightforward KYC procedure, they have a functional eWallet, useful for cash transfers and retail payments but still no bank account.

However, since Wing is a registered partner with Bakong, the user can download the app, which relies on Wing’s KYC confirmation, and create an account on the platform that provides access to the services and institutions registered with the project. This shared responsibility and infrastructure will significantly increase the ease of access to more robust financial services for millions of users, particularly benefitting rural populations.

Cambodia is an envrionment rife with opportunities, and fintech is an industry that can create solutions to benefit the individual, the economy and society as a whole. With new use cases and players entering the market everyday, these opportunities continue to reveal themselves in the Kingdom.

This article was first published in Globe Media Asia’s Focus Cambodia 2021-22 magazine.