Battled and beleaguered, is a depressed Europe an ideal shopping ground for Southeast Asian companies looking for a cheap acquisition?

By Philippe Beco

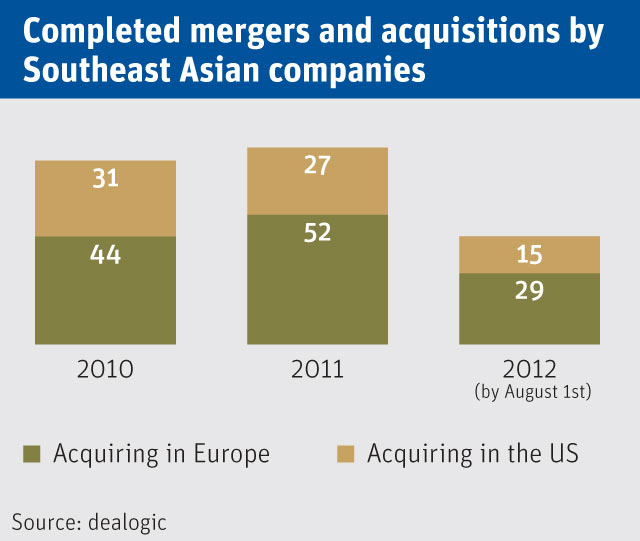

When Royal Dutch Shell recently, and dramatically, bowed out of a six-month bidding battle for Cove Energy, it cleared the way for Thai oil and gas firm PTT to take over the British explorer. The $1.9 billion sale was seen as a major win for the state-backed energy company that is looking to diversify the Kingdom’s energy supplies; it also fuelled talk of a rising Southeast Asian trend of capitalising on a weak Europe.

Looking West: Ernst and Young’s Harsha Basnayake sees opportunities in undervalued EU tech companies

Among the first to kick off a string of corporate transactions in Europe this year was Singapore’s commodity trader Olam International, which in January acquired a 75% equity share of Russia’s Dairy Company (Rusmolco). A couple of months later, Malaysia’s pipe maker Pantech Group took over UK-based Nautic Steels. Recent statements by Singapore’s state investor Temasek Holding and Thailand’s agribusiness group Charoen Pokphand suggest that further deals and acquisitions lie ahead.

With the debt crisis tightening its grip on Europe, growth potential is slowing. Where EU businesses grieve lost glory, Southeast Asian businesses see opportunity. Cheap assets coupled with the decline of the Euro against most Southeast Asian currencies in recent months means that bargain-hunting on the old continent is well and truly on for emerging economies.

“Speaking to Southeast Asian buyers, the depressed European asset prices do indeed make attractive investments,” says Diana Koh, head of KPMG’s Singapore Private Equity and Transaction Services, identifying energy, consumer goods and industrial and financial services as the main sectors to watch.

With the time ripe for cash-rich Southeast Asian investors to expand into new geographic markets, it is also an opportunity to improve business optimisation at a reasonable price.

“Investors are taking advantage of opportunities to address gaps in their supply chain, enhance the integration of their operations or diversify their production bases and bring them closer to specific markets,” says Edward Clayton, Malaysia director for Booz & Company, a global management and strategy consulting firm.

The European situation presents foreign investors with a unique opportunity to tap into a different skill set. “Brands, and the technical know-how, as well as skills in some of these businesses, especially if they can be scaled to other parts of the world, can be attractive propositions,” says Harsha Basnayake, Asean and Singapore leader for Transaction Advisory Service at Ernst & Young. “There is also a very big pool of small to medium businesses with very good technology, tools and systems which may become strategically quite interesting to some of the Asian companies. It is going to be the value extraction strategy that will define the investment appetite.”

PTT Global Chemical’s acquisition of Perstorp Holding France SAS last year is a good example. The French technology firm specialises in isocyanates, a chemical component used in the automobile and construction industries, two of Thailand’s major sectors.

In the energy sector, the need to secure supplies will drive transactions, says Koh. For state-backed PTT, the acquisition of Cove – which has a stake in a Mozambique offshore basin, thought to be one of the world’s richest natural gas discoveries – is central to its push to broaden Thailand’s energy supplies and to increase imports of liquefied natural gas to the energy-starved Kingdom.

Away from the energy industry, Brian Chia, a corporate partner at Wong & Partners law firm in Kuala Lumpur, says the recent acquisition of London’s defunct Battersea power station by a Malaysia-led consortium for $263m points to a strong interest in real property assets.

However, the possibility to buy businesses in Europe at bargain prices may not lead to a surge in transactions, says Basnayake. “I would characterise this to be very much an opportunistic play for many of the Southeast Asian corporates. We don’t see this as a very large appetite because a lot of our corporates may not have the necessary management bandwidth to integrate these businesses post acquisition,” he says, explaining that only large companies will want to make large acquisition moves.

Furthermore, if the European crisis worsens, it may shake Asian confidence, prompting companies to revise expansion plans. Distance, unfamiliar markets and differing legal structures are other elements that could leash Southeast Asian acquisitions.

“The regulatory environment in Europe is much stricter and more sophisticated than in Southeast Asia and the financial markets have a strong emphasis on reporting and disclosures,” says Koh, mentioning Brussels’ strict antitrust rules and regulatory standards for consumer products, which are generally higher in Europe than in Asia.

“Most Southeast Asian economies are dominated by either government-owned or family-owned businesses, and therefore dealing with sophisticated and complex markets is not required in the same way as it is in Europe,” says Clayton, stressing the EU’s stringent environmental rules. “It is not unknown for Asian investors to acquire assets in Europe that have been shunned by European investors. In situations like this, extra care is needed to understand why European investors are not taking advantage of opportunities on their own doorstep.”

“Since Western European countries tend to be more transparent due to regulations, the due diligence process is simpler from a numbers standpoint,” says Koh. “On the flipside, emerging economies in Eastern Europe would be different and deal obstacles could mirror those faced in Southeast Asia. With weaker regulations and lax enforcement, emphasis on due diligence would be of utmost importance.”

Despite the challenges, as Southeast Asia finds its feet and capitalises on its strengths, self-belief will help companies realise ambitious foreign acquisitions. “Maturity and confidence of corporates have a large part to play,” says Wong & Partners’ Brian Chia of Malaysian companies. “Apart from limited growth prospects in their home country, many entities now have a new sense of confidence that they can achieve success outside of their comfort zone.”