In a region where wealth equals status, there’s a world of difference

in the approaches people take to stashing their cash

By Amanda Saxton and Joana Maria Tacken

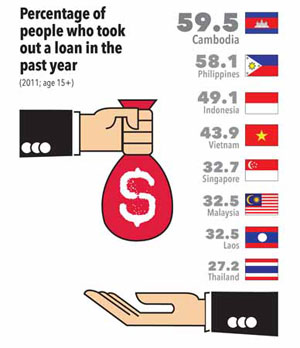

Banking in Southeast Asia is a bipolar industry that reaches all manner of extremes – nearly 100% of Singaporeans over the age of 15 have a bank account, whereas less than 5% of Cambodians in the same age bracket do.

Naturally, this has a lot to do with people’s incomes.

With Singapore’s GDP per capita at purchasing-power parity sitting at a comfortable $49,754 and Cambodia’s at a meagre $1,818 in 2013, according to the International Monetary Fund, the average Singaporean has much more opportunity to open a bank account and accumulate savings.

Banking’s latest fad – making payments online – is taking off in the region. However, access to the internet is a huge factor. This isn’t an issue for wired-up Singapore and Malaysia, or for major Southeast Asian cities such as Bangkok and even Phnom Penh. But out in the countryside it is a different story.

Other factors affecting savings and loans include consumer readiness and the regulatory environment – neither is particularly accommodating across the region.

Mobile payments, where money is transferred via mobile phone and deducted from mobile accounts, is a practical alternative to making online payments. The Philippines leads in this area, using the technology to complete a range of transactions, from remittances to bill payments.