The global market for Islamic bonds is booming, with Malaysia taking the lead

By Gregor Hallmann

In the Qur’an, usury is considered to be among the seven heinous sins. The message is clear: “Those who gorge themselves on usury behave but as he might behave whom Satan has confounded with his touch; for they say, ‘Buying and selling is but a kind of usury’ – the while God has made buying and selling lawful and usury unlawful” (Sura al-Baqara, verse 275).

Therefore, all Islamic financial contracts are drawn up to avoid paying or receiving interest, or riba. In the past, taking interest among themselves was prohibited for Christians, too. The ban was lifted not until the Peace of Westphalia in 1648. Inside the Catholic Church it endured until 1822.

In Islamic law the ban still exists, and the riba-free concept is only one of seven important pillars which form the foundation of Islam’s economic approach.

For Muslims, the use of money for making money is expressly forbidden – instead the shariah requires wealth to be generated from asset-based investments with an equitable sharing of risks.

“This principle lends itself well to investments in listed equity, private equity and real estate,” said Mohieddine Kronfol, chief investment officer for Global Sukuk at Franklin Templeton in Dubai. “That explains where more than two-thirds of shariah-compliant mutual fund assets are currently allocated.”

But the business of real estate is complex, and equity markets tend to be volatile. Obviously, there’s a need among Muslim investors for instruments that deliver a fixed-income stream.

Enter sukuk, which are often referred to as the Islamic equivalent of bonds. Sukuk, the plural of the Arabic word sak (or title deed), can be structured in different ways to comply with Islamic law.

“While a conventional bond is a promise to repay a loan, sukuk constitute partial ownership in receivables (sukuk al-murabaha), a lease (sukuk al-ijara), a project (sukuk al-istisna), a business or partnership (sukuk al-musharaka), or investment (sukuk al-istithmar). In other words, sukuk represent ownership of real assets, whereas conventional bondholders own debt,” Kronfol said.

Instead of paying interest, sukuk coupon payments are lease, rental or profit payments that are passed through to holders. Profits cannot be guaranteed but accrue only if the investment itself yields income. Also, the principal amount is not always guaranteed by the issuer.

“To achieve capital protection, a separate purchase undertaking by a third-party or the issuer in some cases, gives sukuk holders the comfort that the principal will be repaid in full,” Kronfol explained. The structure of sukuk must be confirmed and approved by a shariah adviser who is appointed by the issuer.

While the core principles of Islamic finance are over 1,500 years old and historical reference to the use of sukuk traces back to the 1st Century of the Islamic calender, the first modern sukuk were launched at the beginning of this century. Malaysia pioneered the development of the global sukuk market with the launch of the first sovereign five-year global sukuk worth $600 million in 2002.

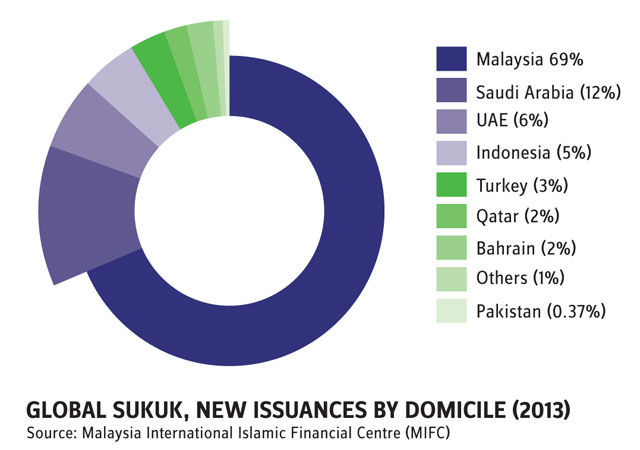

Since then, the issuance has multiplied. It rose from $7.2 billion in 2004 to $119.7 billion last year, according to the Malaysia International Islamic Financial Centre (MIFC). After a setback following the financial crisis, the market is flourishing again. In 2013, Malaysia accounted again for the lion’s share of sukuk issuance, followed by Saudi Arabia, the United Arab Emirates (UAE) and Indonesia.

Global outstanding sukuk reached $269.42 billion at the end of 2013 and the Malaysian market alone stands at more than $100 billion, according to the MIFC. Saudi Arabia, the UAE, Qatar and Indonesia follow significantly behind. Malaysia is also considered to be the most liquid sukuk market, and the country is actively engaged in the standard-setting and international harmonisation of Islamic capital markets.

There are a number of reasons for sukuk gaining ground. “Sukuk are among the best ways of financing large enterprises that are beyond the ability of a single party to do so,” said Zaid el-Mogaddedi, founding managing director of the Institute for Islamic Banking and Finance (IFIBAF), a Frankfurt-based Islamic finance consultancy.

“Sukuk have emerged as an increasingly important asset class, as they have a number of objectives: They enable organisations to raise capital in a shariah-compliant fashion, while at the same time expanding the investor base and offering investment opportunities to new groups,” el-Mogaddedi added.

As the market comes of age there have been a significant diversification of issuers, sectors and underlying assets. The market for sovereign sukuk exemplifies this. Initially, countries outside Asia and the Persian Gulf rarely issued sukuk. In 2004, the German state of Saxony-Anhalt led the way with the launch of the first sovereign sukuk in a non-Islamic jurisdiction.

Others followed: Japan, Luxembourg, Australia, Ireland and France have launched or are considering sukuk issues, and the pipeline for this year includes the announced debut sovereign sukuk issuance from the UK.

Also, renowned multinational companies such as GE Capital and multilateral institutions such as the Islamic Development Bank and the World Bank have already issued sukuk.

No doubt, sukuk are booming. But challenges remain, particularly in that demand by far outstrips supply. “Islamic banking is foremost banking, and it is on its way to becoming part of the banking mainstream,” said el-Mogaddedi.

“The world’s Muslim population, currently numbering some 1.6 billion, accounts for nearly a quarter of the global population, and its share is expected to grow. It is estimated that, within the next eight to ten years, half of all Muslim deposits will be shifted towards shariah-compliant investments,“ he added.

Emerging Asia’s sales of sukuk “remained strong” at $91.7 billion last year, according to the Asian Development Bank’s Asia Bond Monitor. “Sukuk have great potential as a source of financing for infrastructure projects,” the report said, but “governments need to put in place a suitable regulatory framework to encourage borrowers to use them more often.”

Today, shariah-compliant investments make up only a small portion of the world’s financial assets, and only a small percentage of Muslims worldwide use Islamic financial products.

“This share will rise due to better education within the Muslim communities and the growing number of financial experts who are able to explain the distinction between conventional and Islamic banking,” el-Mogaddedi said.

This will spur the hunger for sukuk for religious reasons, but there are other motives for investing in shariah-compliant securities. One is that in Islamic finance, speculative trading and the use of derivatives or leverage are prohibited, and contracts must be free from excessive ambiguity and uncertainty.

This has the effect of insulating the Islamic financial system from risks associated with excessive financial leveraging and speculation.

“An Islamic subprime crisis would have been inconceivable,” el-Mogaddedi noted. He refers to the fact that complex instruments such as collateralised debt obligations that achieved dubious fame during the US financial crisis would not have been permitted under Islamic law.

Shariah-compliant invest-ments must not involve excessive risk or speculation, and they should have a benefit to the wider society. Also, there should be no involvement in unethical businesses such as gaming, tobacco, pornography or firearms.

“Today, more and more non-Islamic asset managers are using a similar approach, but they call it socially responsible, sustainable or ethical investing,” el-Mogaddedi said. Therefore, the scope for the development of sukuk is not restricted to demand from Muslims.

“It is interesting to see that nowadays, more than 50% of conventional investors account for a typical sukuk issuance and the number is still growing,” el-Mogadeddi added.

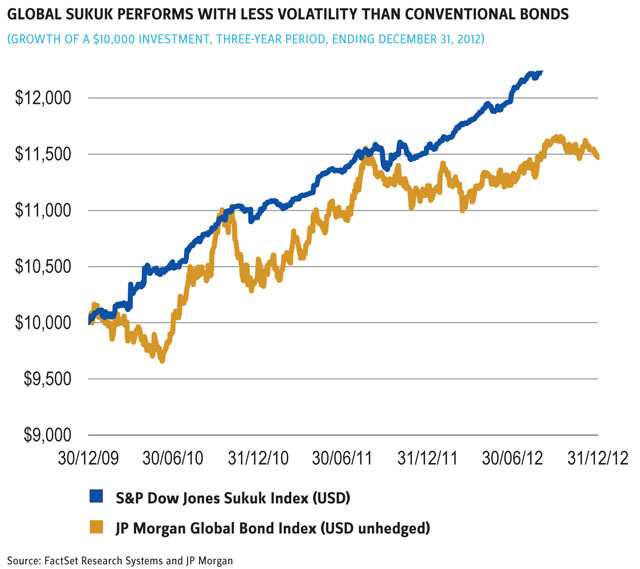

Last but not least, the performance of sukuk is impressive. “The market proved relatively resilient throughout the financial crisis, has largely outperformed many conventional fixed income indexes and displayed less volatility,” Kronfol said.

“The S&P Dow Jones Sukuk Index (in US dollars) has returned on average more than 5% a year in the six years since its inception, despite the global financial crisis and the severe debt crisis in Dubai in 2009. In the three years to end 2012, performance accelerated to an annual average of more

than 7.5%.”

At the same time, the outlook remains promising. “The global sukuk industry is expected to continue being one of the fastest growing segments of the Islamic finance industry,” according to the MIFC’s report, and Malaysia will continue to be the global leader for sukuk issuances this year, followed by the Gulf Cooperation Council group of countries.

But non-Muslim issuers are gaining ground, which is important as multinational companies and sovereign issuers with a prime, or AAA, rating may ease the shortage of top-rated paper on the market. Given this context, planned issuances by countries such as the UK, Luxembourg and Hong Kong, all top-rated, are an encouraging sign.

Another market constraint, the lack of short-term paper, might be mitigated this year by the Jeddah-based Islamic Development Bank, which aims to issue its first short-term sukuk. After the International Islamic Liquidity Management Corporation began to fill the gap last year with issues of

three-month sukuk.

“There is still the perception that sukuk are relatively illiquid,” Kronfol said. “In fact, the market for sukuk has already gained such momentum that secondary market liquidity has improved significantly, with bid-offer spreads that are comparable to those seen in the market for conventional

bond instruments.”

The ingredients for a success story seem to be in place, in particular given the increasing attractiveness for non-Muslim investors. “The Islamic banking concept,” el-Mogaddedi concluded, “is addressed to everyone who is interested in a faith-based economic system with clear rules.”