Strong economic growth and a supply of cheap money is likely to drive Southeast Asia’s property markets this year, even as risks loom

By Christian Vits

Asean’s property market welcomed a new star last year: Jakarta. Indonesia’s capital recorded the largest increase in office rentals worldwide, surging to an impressive 25.8%. “Jakarta’s role as the gateway and service hub to the world’s fourth most populous nation is helping to drive strong economic and real-estate momentum,” according to a research note from Jones Lang LaSalle (JLL), a commercial real-estate services and investment management company. “Robust demand from international corporations” led to the city’s upsurge last year, “and in 2014 it is likely to again be among the best performers”.

But Jakarta is not the only hotspot when it comes to rising office rentals. Bangkok and Singapore recorded annual increases of 11.5% and 8.4% respectively last year. “Demand fundamentals in the commercial [market] are positive, with sustained occupational demand from both foreign and local enterprises,” said Simon Lo, executive director of research and advisory services, Asia, at Colliers International. “Due to the tight supply situation in traditional central business districts such as Makati in the Philippines, rentals in the core locations would continue to surge.”

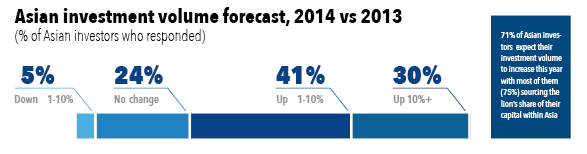

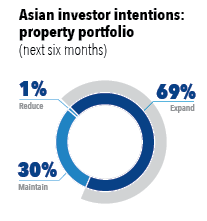

In Asia-Pacific, investment sentiment is expected to remain strong this year. “Despite the increased risk premium among Asian investors, capital is likely to continue flowing into the region in the long term,” states Colliers’ 2014 Global Investor Sentiment survey, which includes responses from more than 520 participants. According to the survey, 62% of Asian investors believe the region’s property markets will improve over the next 12 months. Some 69% of Asian investors plan to increase their property portfolio during the next six months, and 77% said their primary investment focus will be Asia.

Another promising country is the Philippines, where Manila’s market has “once again outperformed the rest of Southeast Asia in terms of capital value gains in the office segment”, said Chua Yang Liang, head of research, Southeast Asia, at JLL. “The strong office demand from the information technology, consumer goods, pharmaceutical and real-estate sectors have pushed up Manila office rents. The stable performance in the office-leasing market has sustained investors’ interests and sentiments, driving capital values up by 5.2% [in the fourth quarter of last year], way surpassing rental growth, [and] this trend is likely to continue,” Liang added.

Even less-storied markets such as Phnom Penh are experiencing increased attention, with office market supply set to increase in excess of 30% this year, according to CBRE, a global commercial real estate services company.

“[In the residential sector] there remains strong demand for serviced apartment space in Phnom Penh. This demand is set to continue in 2014. Rental rates for retail space in prime locations within well-managed multi-tenant buildings are [also] set to increase,” according to a CBRE report.

In Vietnam, there are “early indications that market sentiment is improving” after suffering “a torrid time over the past few years”, said Stephen Wyatt, JLL’s Vietnam country head. He cites the downward trend in inflation, lower interest rates, increasing foreign investments and an improved trade surplus. “The economy is in a much better situation,” Wyatt added. “The overall message is: The champagne can be put on ice, but it’s still too early to uncork it.”

There’s an “ongoing willingness to look at emerging markets, in particular Indonesia and the Philippines, as alternatives to other more traditionally favoured markets”, according to a survey from the Urban Land Institute and PricewaterhouseCoopers that identified the “top trends” in the industry. “With higher interest rates seemingly just around the corner, investors are drifting to markets and asset classes that can provide the kind of returns they are unable to tap elsewhere,” stated the report.

At the same time, there have been signs of an overheating in the residential sector, prompting administrative measures to cool the market. Singapore capped total consumer debt available from banks at 60% of borrowers’ incomes. In Malaysia, the government doubled the minimum amount foreigners must spend on property and raised the capital gains tax to 30% on homes they sell within five years after Singapore’s property boom threatened to spill over to the neighbouring country.

Household debt in Malaysia has already risen to more than 80% of GDP, the highest rate in Southeast Asia, while Thai borrowers accumulated almost 70% of GDP, fuelling fears of a financial crash due to the property sector.

Still, external factors might hamper market dynamics. One danger is a more pronounced slowdown in China’s economy. If Asean’s main trading partner is losing steam, the region’s real-estate markets will be affected, not only with regard to Chinese capital inflows, but also because of indirect effects stemming from sagging exports.

Secondly, the tightening of monetary policies, in particular in the US, has triggered concerns that rising interest rates may overburden property investors. “When looking at the debt situation in many Asian countries, a perfect storm scenario of rising interest rates and a severe economic slowdown could potentially bring about a serious debt problem,” Nicholas Holt, Asia-Pacific research director at real estate consultancy Knight Frank, wrote in a paper. Still, “the systemic risk looks low”, he added, as Asian banks were much less leveraged than their Western counterparts prior to the credit crisis.

“There might be some risks for individual developers who have overly leveraged themselves in the past couple of years,” agreed Colliers’ Lo. “Since most Asian banks have been prudent in offering loans to their customers via conservative loan-to-value ratios and a number of stress tests, our view is that risk is there but the system is safe.”

Keep reading:

“The beach buys“ – As the Philippines enjoys impressive economic growth, the country’s most popular beach destination could offer investors a real estate bounty