As funds flee, India’s pain is Southeast Asia’s gain

Southeast Asian nations are swallowing an outflow of money from India, as foreign investors lose patience with its policy paralysis and slowing growth and aim instead for more promising emerging markets such as Indonesia.

Corruption scandals and high inflation have added to India’s woes, which have seen growth slow to a three-year low while the fiscal deficit widened to 5.9% of gross domestic product in the last financial year.

“India was sold on the promise of high growth which simply hasn’t panned out over the past four years,” said Gautam Prakash, founder of United States-based hedge fund Monsoon Capital. Foreign investors pulled a net $540m out from India in March and April, compared with $13 billion in inflows in January-February.

Foreign portfolio flows into Indian stocks have dropped 99% to just 5.17 billion rupees ($94m) since a March budget that largely disappointed investors, compared with 4.3 billion rupees ($78m) in 2012 before the budget.

Among the most significant developments from the shift has been the direction in which money is headed, with a large chunk flowing to Jakarta and other Southeast Asian capitals. Two provisions put forward in the budget to tax indirect investments and combat tax evasion were the last straw for some global mutual funds, prompting an acceleration of money leaving India. While the provisions were later put on ice, the prospect that such a tax could be proposed in India was enough for some investors to send their Asia-allocated money further east.

“You’re seeing a situation where the ‘I’ in Bric is being replaced by Indonesia,” said Tim Condon, head of research and strategy for Asia at ING, referring to the Brazil, Russia, India and China bloc.

Left out

An emerging market brochure distributed by Franklin Templeton last month had data on India missing from a world map. From a global leader in emerging market investing, led by omnipresent guru Mark Mobius, that omission was telling.

India exposure in Asia’s biggest equity fund, the $18 billion Templeton Asian Growth fund, dropped to 16% of its assets at the end of March from nearly 20% a year ago, while exposure to Asean countries rose to 35% from 31% during the period.

An Asean-focused equity fund launched by Daiwa Asset Management started with about $366m in February and has since grown to manage about $430m, while Fidelity Funds-Asean has seen a net inflow of nearly $250m in the last year.

The bigger Asean markets do not necessarily offer a compelling case on valuation grounds.

“Generally, we are more negative on India than we are positive on the alternatives, such as Indonesia and the Philippines where we feel the markets have perhaps run ahead of themselves,” said David Baran, co-founder of Tokyo-based hedge fund Symphony Financial Partners.

“The Asean alternatives do have more positives and less negatives than India, and we think that foreign investment outflows from India into the Asean alternatives are highly likely to increase if anything.”

Indian shares trade at price to book value of 1.9 times, higher than 1.4 times for Asia Pacific shares as a whole but less than 3.1 times for Indonesia, 2.2 times for Thailand and 2.5 times for the Philippines, according to data from Thomson Reuters StarMine.

The trend, nonetheless, is clear, as money managers shift away from India, at least for the short-term, towards markets that offer the same favourable demographics and growth potential that had previously drawn investors to Delhi and Mumbai.

Betting on Asean

Funds from firms such as Aberdeen, Matthews and T. Rowe with mandates to bet in Asia invested a smaller percentage of their assets in India at the end of March compared with the year-ago period and more in Indonesia and other Southeast Asian countries than they did a year ago.

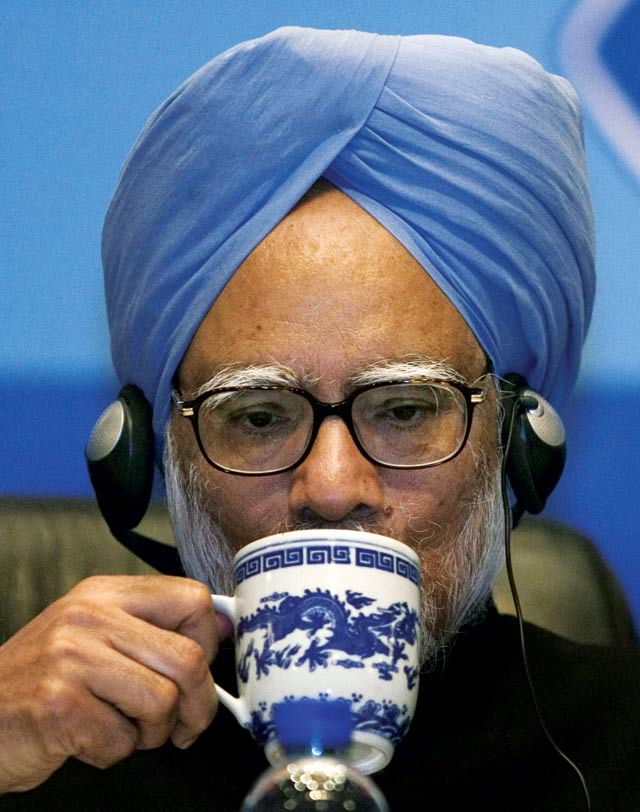

Back stage: India’s prime minister Manmohan Singh (right) is facing stiff competition from Southeast Asia’s largest economy, Indonesia

Part of the drop is due to a fall in the value of holdings, but fund flow data tracked by Lipper shows mutual fund clients are responding as well, giving more ammunition to funds betting on Southeast Asia and less to those investing in India.

Investors pulled out nearly $480m from offshore India dedicated funds in April, increasing the 12-month cumulative net outflows to about $4.1 billion, according to data from Lipper.

By comparison, funds investing in Southeast Asia have seen net inflows of about $900m in the year ending April.

The gap between the total assets under offshore India funds and that of Southeast Asia fell to a three-year low of about $13.5 billion in April, indicating investors were buying into a region that is home to nearly 600 million people. Indonesia-focused bond funds are in favour too, with eight such funds collecting a cumulative $355m in the year ending April. HSBC Indonesia Bond Open received $200m alone.

“We are seeing more interest in Asean,” said Matt Pecot, head of Credit Suisse’s prime broking unit in the Asia Pacific.

Net exposure to India in Asia-focused hedge fund portfolios fell to 18.7% in April from 32.5% in January 2011, according to data compiled by Credit Suisse based on their client portfolios. The same measure for Indonesia surged to 51.8% in April from 24.7% in January 2011. Net exposure refers to the difference between a hedge fund’s long positions and short positions. A higher net exposure means funds are expecting the stock market to rise.

Bric hits wall

Ten years ago, chairman of Goldman Sachs Asset Management Jim O’Neill, then the bank’s chief economist, combined the emerging market growth stories of Brazil, Russia, India and China to coin the famous Bric moniker. O’Neill recently called India the “biggest disappointment” of the Bric nations.

“India was a 9 to 10% growth economy when the Brics were put together and now it’s slowing. Indonesia was a 4 to 5% growth economy and it’s moving in the other direction,” ING’s Condon said.

The top-three Bric mutual funds by assets invested a smaller percentage of their assets into India at the end of March than they did a year back, according to data from Lipper. They are also underweight compared with their benchmark, meaning they do not expect India to contribute to portfolio outperformance.

Templeton Bric fund had 11.7% of its assets in India, its lowest since June 2009.

“India is getting trapped in that high fiscal deficit, high current account deficit situation and there is no easy way out of that unless it takes the tough steps,” said Binay Chandgothia, portfolio manager at Principal Global Investors.

Indonesia and the Philippines, meanwhile, have neither current accounts nor significant budget deficits to worry about, although they do share some of India’s problems such as fuel and food subsidies, Symphony Financial Partners’ Baran said.

With combined GDP of $2 trillion, the 10-member Asean is angling for foreign investment. Ranging from resource-rich Indonesia to impoverished Laos and financial centre Singapore, Asean is planning a union by 2015 to allow for free flow of goods, capital, services and labour.

“As far as stock prices go, foreigners own approximately 40% of the free float of the Indian market,” Baran said.

“It will not take much of an exodus for this to have a significant impact on the market and there are clearly plenty of alternatives in Asean.”